The history of money is a fascinating journey through time, revealing how various forms of currency have shaped societies and influenced power dynamics.

From the earliest use of shells to the rise of digital currencies, each stage in the evolution of money tells a unique story about its role in human civilization.

This blog post explores eight pivotal facts that highlight the transformation of money across different cultures and eras, demonstrating how it has become a defining element of power and influence in the world.

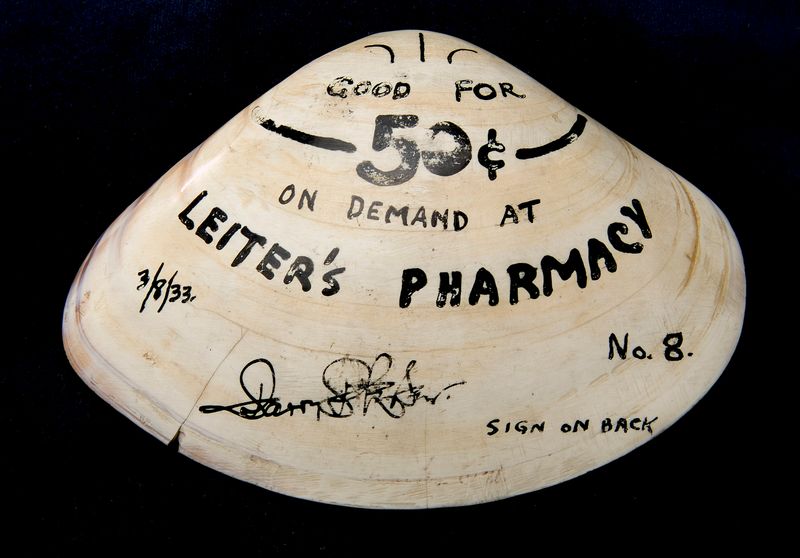

1. Shell Money: The First Currency

Shell money, particularly cowrie shells, represents one of the earliest forms of currency. Used extensively in Asia, Africa, and the Indian Ocean, these shells were valued for their beauty and rarity. Cowrie shells facilitated trade across vast regions, symbolizing wealth and status in many cultures.

Their uniformity made them an ideal medium of exchange, unlike barter systems. As societies evolved, so did their need for standardized money, paving the way for coins. Shell money’s significance declined with the advent of metals, but its impact on early trade systems remains profound.

2. The Rise of Coinage

The introduction of coinage revolutionized trade and economic systems. The Lydians, around 600 BCE, are credited with minting the first coins from electrum, an alloy of gold and silver. Coins offered a standardized form of money, facilitating trade and taxation.

Their durability and portability made them an effective tool for commerce, enhancing economic growth. Coins also served as state propaganda, often bearing images of rulers or deities. This innovation marked a significant leap forward from previous systems, establishing foundational principles that underpin modern monetary systems.

3. Paper Money: China’s Innovation

Paper money first emerged in China during the Tang Dynasty (618-907 AD) as a convenient alternative to heavy coins. Initially used by merchants, it evolved into a widespread currency under the Song Dynasty. This innovation reduced the burden of carrying metal currency, promoting extensive trade.

Government-backed paper notes enhanced economic stability and growth. However, overproduction sometimes led to inflation, highlighting challenges in managing currency supply. China’s invention of paper money set a precedent for global adoption, shaping future financial systems worldwide and emphasizing the importance of trust in monetary value.

4. Gold Standard Era

The Gold Standard established a link between currency and gold, providing stability and trust. Adopted in the 19th century, it required countries to back their currencies with gold reserves. This system facilitated international trade by ensuring consistent exchange rates.

However, it restricted monetary policy flexibility, often leading to economic rigidity. The Gold Standard eventually collapsed during the Great Depression, as countries needed more economic tools to manage crises.

Despite its limitations, it laid critical groundwork for modern monetary policies, influencing current discussions on currency stability and inflation control.

5. The Birth of Modern Banking

Modern banking traces its roots to medieval Italy, where merchants needed reliable methods to store and transfer wealth. Institutions like the Medici Bank pioneered practices such as double-entry bookkeeping and credit systems. These innovations fostered financial growth and economic expansion across Europe.

Banking became a cornerstone of economic life, providing loans and safeguarding deposits. This evolution supported burgeoning trade and commerce, laying the foundation for today’s complex financial systems.

The achievements of early banking continue to influence our understanding of credit, investment, and risk management.

6. Introduction of Paper Checks

Paper checks emerged as a practical solution to safely transfer large sums without physical money. Popularized in 18th-century Britain, checks offered security and convenience, reducing the risks associated with cash transactions.

They allowed for deferred payments, aiding in budgeting and financial planning for individuals and businesses. As checks became widely accepted, banking infrastructure expanded to support them.

Although digital payments are now prevalent, checks remain a testament to the adaptability of financial systems. They played a crucial role in the transition to modern banking, illustrating the evolution of payment methods over time.

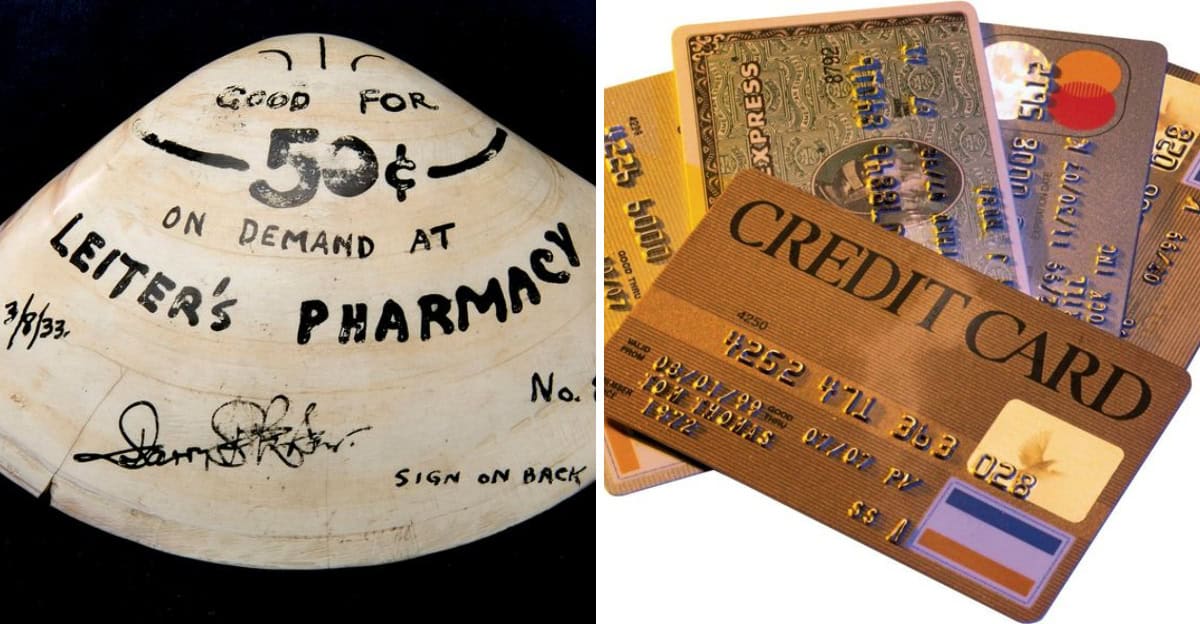

7. The Emergence of Credit Cards

Credit cards revolutionized consumer spending by offering a cashless payment method. Introduced in the 1950s, these cards provided unprecedented purchasing power and flexibility. They enabled people to buy now and pay later, fostering consumer confidence and economic growth.

The convenience of credit cards led to widespread adoption, influencing spending habits and financial planning. Over time, credit card technology has evolved, incorporating security features and mobile payment options.

This financial tool remains integral to modern commerce, highlighting the ongoing innovation in monetary systems.

8. Rise of Digital Currency

Digital currency represents the latest transformation in the evolution of money. Cryptocurrencies like Bitcoin have gained traction for their decentralized nature, offering an alternative to traditional banking systems. Digital currencies promise faster transactions and reduced fees, appealing to a globalized economy.

However, they also pose regulatory challenges and concerns over security. The rise of digital currency reflects society’s shift towards a technologically-driven future, emphasizing the need for adaptable financial systems.

As digital economies expand, these currencies continue to redefine how we perceive and use money in daily life.